REGISTERED RETIREMENT SAVINGS PLAN (RRSP)

Secure your financial future today. Contact us to set up your RRSP and take the first step toward your goals.

What is an RRSP?

An RRSP (Registered Retirement Savings Plan) is a government-registered savings plan designed to help Canadians save for retirement. But it’s more than just a retirement tool – it can also be used for:

- Purchasing your first home (Home Buyers’ Plan – HBP).

- Financing your education (Lifelong Learning Plan – LLP).

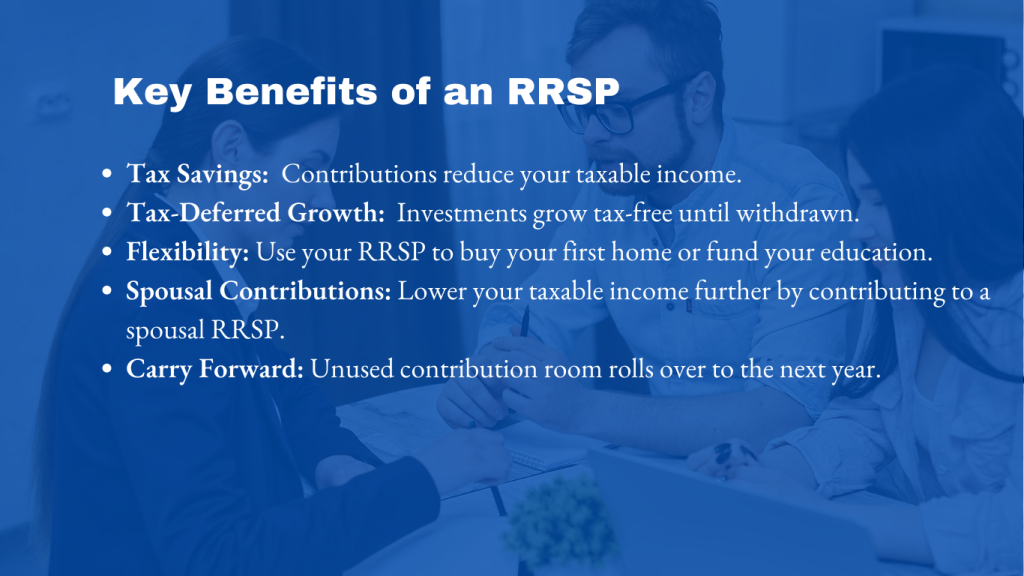

Key Tax Advantages:

- Tax-deductible contributions: Lower your taxable income by deducting your RRSP contributions.

- Tax-deferred growth: Any investment growth inside your RRSP is tax-free until withdrawn.

How Much Can You Contribute?

For the 2024 tax year:

- You can contribute 18% of your annual income, up to a maximum of $31,560.

- Any unused contribution room from previous years can be carried forward, allowing you to maximize your investments.

How to Maximize Your RRSP Contributions?

Consider an RRSP loan to take full advantage of your contribution room. This strategy can help you benefit from immediate tax savings and long-term growth.

Contribution Deadline

- For the 2024 tax year, you have until March 3, 2025, to make contributions and claim tax deductions.

- Contributions after this date will apply to your next tax return.

Investment Options for Your RRSP

we provide investment solutions tailored to your financial goals and risk tolerance

Segregated Funds

Combine the benefits of mutual funds with protection against market downturns..Guaranteed Interest Funds

Enjoy fixed returns and 100% capital protection.High-Interest Savings Accounts

Save risk-free and earn competitive interest rates.Daily Interest Funds

Earn daily interest, paid monthly, to grow your investments steadily